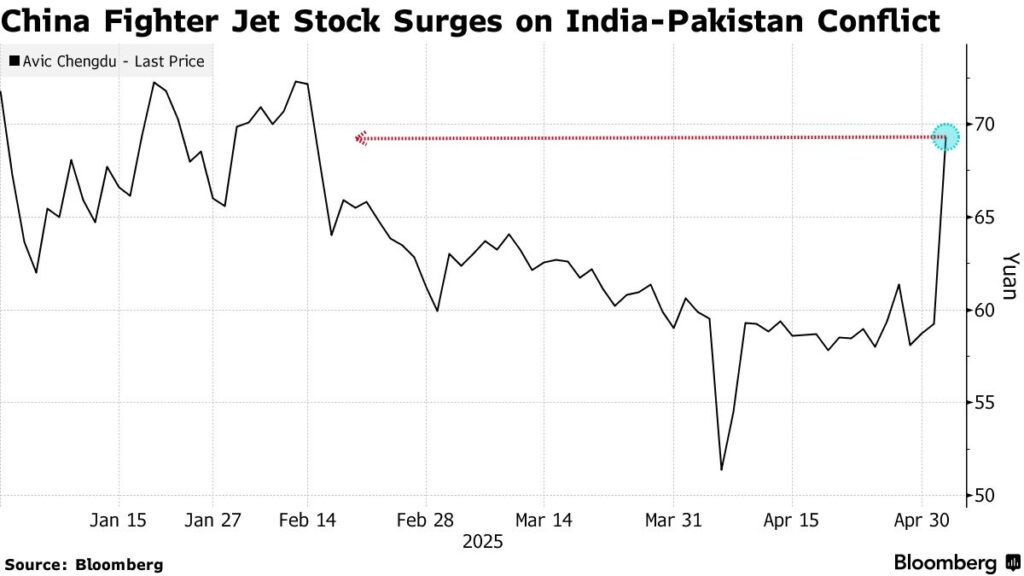

Chengdu Aircraft Corporation (CAC), the Chinese company behind the J-10C fighter jet, has seen a major rise in its stock value following the recent India-Pakistan conflict. The company’s stock jumped by 20 per cent on May 12, reaching CNY 95.86. This marks a 60 per cent increase in just one week.

According to Bloomberg, CAC’s market value increased by more than 55 billion yuan or about 7.6 billion US dollars. This happened soon after reports confirmed that Pakistan used J-10C fighter jets during a short but intense air clash with India. During the conflict, Pakistan’s air force successfully used the J-10C jets to shoot down five Indian aircraft, including three French-made Rafale jets.

The India-Pakistan military exchange involved not only fighter jets but also missile strikes, drone attacks, and artillery fire. The situation was tense and dangerous. However, it ended with a ceasefire that was arranged by the United States. Even though the fighting stopped, its effects are still being felt in the defense industry, especially when it comes to international perceptions of military strength.

The use of Chinese fighter jets in a real-world conflict has drawn the attention of both investors and military experts. Many are now questioning the long-held belief that Western weapons are always better than those made by China. The successful use of the J-10C has shown that Chinese technology is now capable of competing with and possibly outperforming, some of the world’s most advanced systems.

James Char, an expert at the China Program of the S. Rajaratnam School of International Studies, said that this situation could make Chinese weapons more attractive to developing countries. He pointed out that the J-10C is not even China’s most advanced fighter jet, which makes its performance even more impressive. He believes countries in the Global South will now be more open to buying Chinese arms.

China is already the fourth-largest weapons exporter in the world. Most of its customers are in developing countries like Pakistan, and this recent event could help China gain new buyers in Asia, Africa, and the Middle East. Rising political tensions around the world are pushing many countries to increase their defense spending and many are looking for more affordable but effective weapons systems.

As Chengdu Aircraft Corporation enjoyed a major boost, French company Dassault Aviation, which builds the Rafale jet, experienced the opposite. After reports of the Indian Air Force losing several Rafale jets, Dassault’s stock fell from EUR 325.8 on May 5 to EUR 314.6 on May 9, a drop of about 3.4 per cent. This shows how quickly stock prices can change depending on how well military products perform in actual combat.

Another Chinese military product also got global attention during the conflict — the PL-15 air-to-air missile. After the fighting, parts of the missile were reportedly found in India, suggesting that it may have been used for the first time in real combat. The PL-15 can fly faster than Mach 5 and is considered to be on the same level as the U.S.-made AIM-120 AMRAAM.

With weapons like the J-10C and PL-15 performing well in actual battles, more countries may turn to China for their defense needs. Investors are now seeing Chinese defense companies like CAC as strong competitors in the global arms market. This has led to a big shift in investor interest from traditional Western defense firms to rising players like China.

The success of the J-10C is not only helping CAC financially but also improving China’s reputation in the global defense industry. This could mean more deals, more partnerships, and more trust in Chinese technology in the future. Military experts and governments around the world are now taking a closer look at what China has to offer.

As tensions continue in different parts of the world and as countries look for cost-effective solutions for defense, Chinese companies like Chengdu Aircraft Corporation could become leading suppliers. The recent events have proven that China’s military hardware can perform in real situations, and that is exactly what global buyers are now looking for.